News

Bank Launches Square-like Device in the Philippines

May 8, 2013

Article that appeared in Tech in Asia covering the launch of BPI's mPOS platform that utilizes SCCP's Swiff mPOS solution. Read more at http://bit.ly/11RRt17

You seldom hear of banks or financial establishments involving themselves directly in technology trends or releases, at lea st not directly, and even more so in the Philippines. Yes, we’ve had electronic banking for a while now, and banks are always touting their latest innovations in online shopping and connectivity. But an actual hardware product innovation developed, produced and released by the bank itself? A bit rare that.

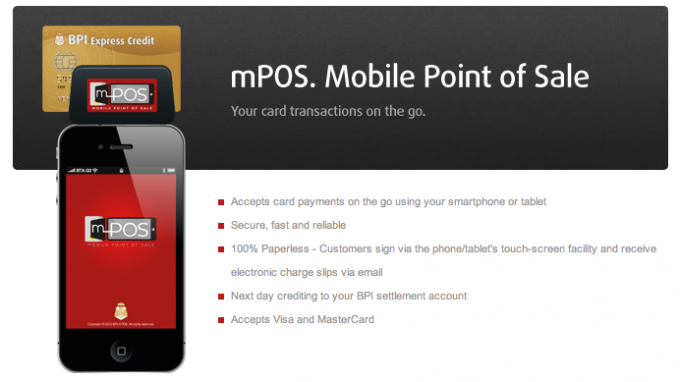

So it was a bit of a breath of fresh air when the Bank of the Philippine Islands (BPI) announced the development of what they hope will give them an edge in the burgeoning e-commerce and mobile purchasing field, the BPI mPOS, or Mobile Point of Sale.

SCCP Group partners with the Bank of the Philippine Islands (BPI) to set the trend for the future of mobile payments

SCCP Group’s partnership with the Bank of the Philippine Islands (BPI) sets the trend for the future of mobile payments through the launch of an innovative solution for merchants in the Philippines.

Today, the global innovator of secure mobile commerce solutions, Swiff announced the Philippines first complete live implementation of an end-to-end, secure mobile point of sale (mPOS) solution.

The partnership between the Bank of the Philippine Islands (BPI) and the Swiff platform will allow BPI to provide their customers with new retail opportunities made possible by the flexibility and low cost of Mobile POS. “Not only is it easy to use, mPOS does not require business to maintain a minimum volume of transactions so they can keep using the service once they sign up” says BPI Vice President, Kay Dela Paz.

“This is an exciting time for the payment industry, with technology being the bedrock for enhanced mobility, payments, convenience and productivity improvements,” said Jerome Cle, CEO and Founder of SCCP Group. “We’re ready to empower banks worldwide with technologies that enable truly secure mobile strategies, allowing them to stay competitive in the m-commerce revolution and take back market share from aggregators in that market.”

Unlike other mobile payment companies, Swiff is not a payment aggregator. As a technology provider and partner to the banking and financial industry, Swiff’s innovative and unique technology give banks the tools to roll out mobile strategies that enable bank-level secured, authenticated transactions. To ensure security, Swiff’s mobile platform embeds a Multi-Factor Authentication application that has the ability to track the mobile device, the staff that authorized the transaction, and identify the location where the payment was transacted. This enables the quick identification of any possible fraudulent use of the credit card, and promises an extremely high level of security for safe and secure card transactions.

Our strongest differentiator lies in our ability to seamlessly integrate into any acquiring bank, allowing the bank to rapidly provide an mPOS service to existing and new merchants. On the commercial front, we are opening doors for banks to achieve a richer level of engagement with their merchants, supporting the process of the revolution in business that mPOS brings.,” said Belinda Aka, VP Business Development of SCCP Group.

Swiff was first launched by SCCP Group in Singapore in March 2012. Plans are currently underway to develop bank partnerships in growing markets in the US, Europe, and Asia Pacific.

Kunsgri, KBank Leading the Charge

Mobile point of sale tech push

Sucheera Pinijparakarn | As appeared in theThe Nation April 22, 2013 1:00 am - Read full article at http://bit.ly/10BNyu8

Two banks are aggressively promoting MPOS (mobile point of sale) technology in an effort to expand the use of this payment method. The payment service is supported by Visa and powered by SCCP Group's Swiff mobile-payment platform, which has been designed to help merchants receive credit-card payments using mobile devices with advanced security.

Since the launch of MPOS last September, the number of merchants adopting it has been small, said Thakorn Piyaphan, managing director of Krungsri Consumer.

"We have expanded the MPOS technology for use with Android smart phones and not only iPhones and iPads, and it now can also accept debit cards as well as credit cards. We believe this expansion will help increase the number of merchants" using it, he said.

Krungsri is signing up more corporates and merchants for the service, focusing on delivery services, auto dealers and small businesses in Platinum Fashion Mall Wholesale. Moreover it will reduce the documents required for small businesses not registered as companies.

"We are hiring an outside company to sell the MPOS payment system to small businesses because this kind of customer needs to be educated on the technology. We believe MPOS transactions will be increased soon," he said.

MPOS transactions at Krungsri currently average Bt100,000 per merchant per month. Krungsri targets selling 15,000 MPOS accounts to merchants by the end of the year.

Kasikornbank executive vice president Chatchai Payuhanaveechai said the bank had around 10 corporate partners that planned to use MPOS. KBank launched K-Merchant on Mobile last October with the first three partners Nok Air, Muang Thai Life Assurance and Amway (Thailand).

The growth rate of spending via |this technology has been good thanks to the high number of agents of the first three partners. The bank aims to sell more than 20,000 MPOS accounts by the end of the year after acquiring more partners.

"The next stage is to focus on small businesses such as delivery services and direct sales, and we have set up a sales team to offer K-Merchant on Mobile to merchant customers. We will [offer] free MPOS to merchants that have monthly transactions of more than Bt50,000 and gift vouchers to encourage small and medium-sized enterprises to use MPOS," Chatchai said.

Merchants normally pay Bt2,500 for MPOS, lower than electronic data capture (EDC), for which they have to pay a monthly fee of about Bt500-Bt1,000.

Transactions via K-Merchant on Mobile at present amount to less than half those through EDC.

Swiff Secure at Paris-Europlace International Financial Forum 2013 in New York

SCCP Group Joins French Delegation to NYSE/EuroNext featuring European Economic Expansion and Investment Opportunities

April 22, 2013 – New York, NY – Swiff Secure, the mobile payment security solution from SCCP Group participated in the annual Paris EUROPLACE International Financial Forum at the New York Stock Exchange on Monday, April 22nd. Benoit Delestre, President of SCCP Group France, showcased Swiff’s Patented Multi-Factor Authentication for Mobile Payments during a special panel organized by the Finance Innovation Cluster.

Speaking on the occasion, Jerome Cle, Founder and Chief Executive Officer of SCCP Group said, “In all of our offices from Paris to San Francisco and Singapore, across all markets globally, our businesses are experiencing exponential growth. The tailored technology innovations that Swiff offers, such as Swiff mPOS and mWallet, transcend any regulatory issues confronting the mobile payments industry. It is my privilege to share our company’s success with such a highly esteemed group representing the financial services industry from Europe.”

Paris-Europlace is organized with the support of Banque de France. The Forum offers a full-day program and international dialogue that explores ways to restore and expand economic growth in Europe, the investment opportunities now present there, as well as regulatory issues and convergence between Europe and the United States.

About Paris EUROPLACE

Paris EUROPLACE is the professional body, which supports the France-based financial services industry and promotes Paris as an international financial center.

Swiff Cites Security As mPOS Differentiator

April 17, 2013. PYMNTS.COM Q&A with Jerome Cle, SCCP Group CEO. Jerome shares his expert insight on current and future trends in mobile payment and tells how Swiff products are changing the m-commerce game for all players worldwide

Can you briefly explain your products and what makes them special?

Swiff is the world’s first white label end-to-end mobile commerce (m-Commerce) platform to offer patented bank-standard security. Our m-commerce solutions can be seamlessly integrated as a whole, or as individual plug-ins to existing technology infrastructure. Our products facilitate secure and instantaneous cashless payments between consumers, merchants and banks. Unlike many of our competitors, we act as a pure-play technology partner to banks and financial institutions

The mobile payment market is huge right now! Why do you think Swiff has been so successful?

Swiff is at the forefront of the m-commerce revolution; a vector in the move towards a cashless world. Merchants and consumers everywhere are beginning to embrace the power of mobile devices as a means to pay and get paid. Because there are so many m-commerce vendors, Swiff offers a unique combination of flexibility, innovation and security in its platform, while maintaining a low-cost.

Swiff represents a giant leap forward in fraud detection and prevention. We reduce the need for Card Not Present (CNP) transactions, which reduces fraud and chargebacks. We use a plug-in device and a Multi-Factor Authentication application that has the ability to track mobile devices; the employee who initiated the transaction; and the precise location of the transaction. Additionally, Swiff is EMV Level 2 Certified - the highest possible payment industry standard for secure and compliant transactions.

For the full interview, click the following link: http://bit.ly/YUownS

Page 2 of 7

<< Start < Prev 1 2 3 4 5 6 7 Next > End >>